How To Set and Keep Personal Financial Goals

Higher Education and Research Infrastructure

Welcome to Social Service of America's comprehensive guide on setting and achieving personal financial goals. In this article, we will provide you with valuable insights, practical tips, and essential resources to assist you in creating a robust financial plan for a brighter and more prosperous future.

The Importance of Personal Financial Goals

Setting personal financial goals is crucial for numerous reasons. By defining clear objectives, you can make informed decisions that align with your long-term aspirations. Here are some key reasons why setting and striving towards these goals is essential:

- Financial Stability: Goals help you build a solid foundation for financial stability, ensuring you have enough savings and resources to meet your needs and handle unexpected expenses.

- Debt Reduction: Setting goals allows you to outline a plan to reduce and manage your debts effectively. This includes paying off credit card balances, loans, or mortgages.

- Wealth Creation: By setting clear financial goals, you can develop a strategy to accumulate wealth, whether it's through investments, retirement plans, or property ownership.

- Improved Financial Decision Making: With defined goals, you can make informed choices about your spending and saving habits, ensuring that your financial decisions align with your long-term objectives.

- Peace of Mind: Setting and consistently working towards your financial goals provides a sense of security, confidence, and peace of mind, knowing that you are heading in the right direction.

The Process of Setting Personal Financial Goals

Creating personal financial goals involves a series of steps to ensure that your objectives are well-defined, realistic, and tailored to your individual circumstances. Let's explore each step in detail:

1. Evaluate Your Current Financial Situation

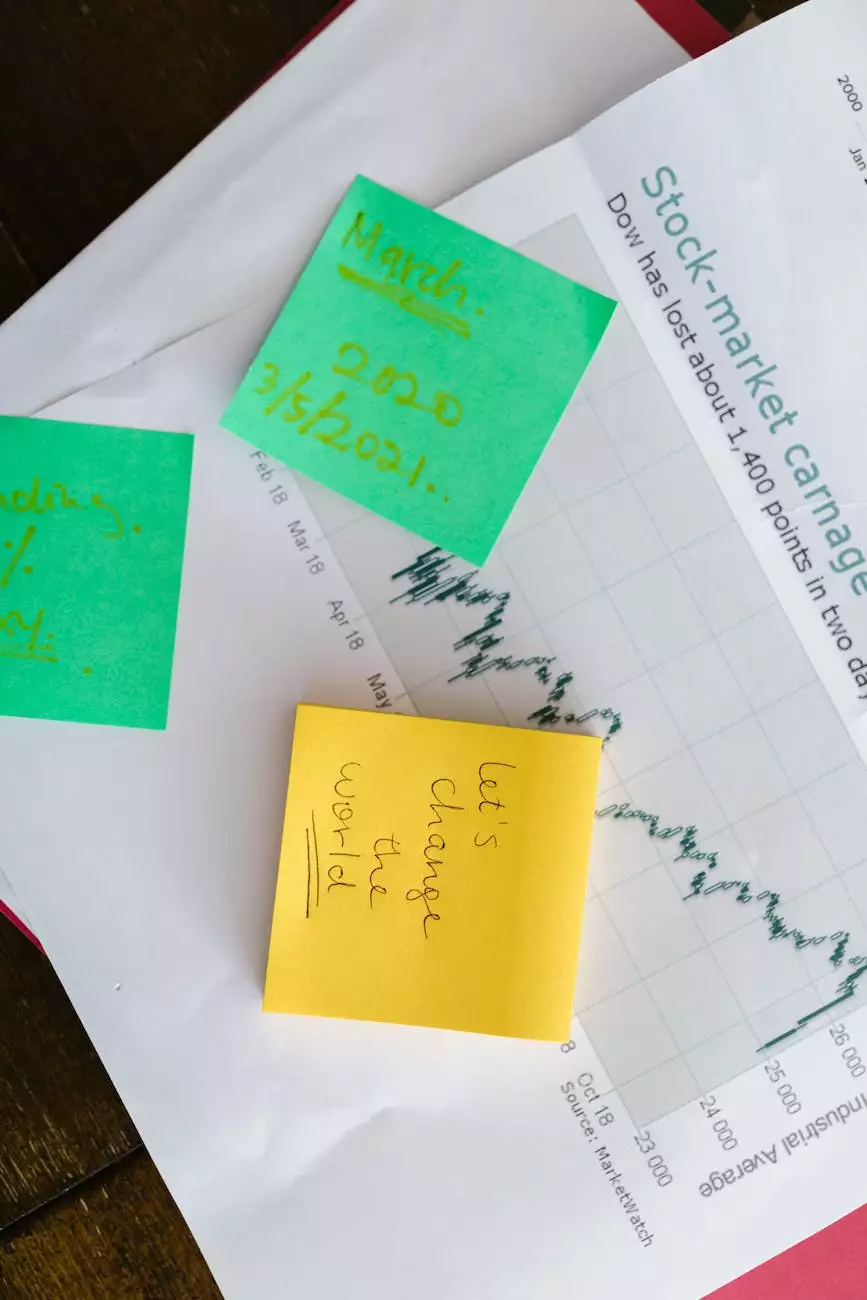

Before setting any goals, it's important to have a clear understanding of your current financial condition. Evaluate your income, expenses, assets, and liabilities to gain insights into your overall financial health. This assessment will help you identify areas that require improvement and provide a baseline to measure your progress against.

2. Define Your Short-Term and Long-Term Goals

Consider both short-term and long-term financial goals to ensure a balanced and comprehensive approach. Short-term goals may include building an emergency fund, paying off high-interest debts, or saving for a vacation. Long-term goals might involve retirement planning, property purchase, or funding your children's education.

3. Make Your Goals Specific and Measurable

Broad goals are less effective, so it's important to make them specific and measurable. For example, rather than stating "I want to save more money," specify a specific amount or percentage you wish to save each month. This will provide a clear target and allow you to track your progress effectively.

4. Set Realistic and Attainable Goals

While it's important to dream big, it's equally important to set realistic and attainable goals. Evaluate your current financial capabilities and limitations to ensure that your goals are within reach. Setting unachievable goals can lead to frustration and demotivation. Start with smaller milestones and gradually work your way up.

5. Create a Timeline and Action Plan

Establishing a timeline and action plan is critical for accomplishing your financial goals. Break down your goals into smaller, manageable tasks and assign specific deadlines to each of them. This will help you stay organized, focused, and proactive in your pursuit of financial success.

6. Seek Professional Advice and Educate Yourself

Seeking professional advice from financial planners or advisors can provide valuable insights into effective goal setting and financial planning. Additionally, educating yourself about personal finance through books, articles, and online resources can empower you to make informed decisions and take control of your financial future.

7. Monitor Your Progress and Make Adjustments

Regularly monitor your progress and assess how well you're sticking to your action plan. If necessary, make adjustments or modifications to ensure that you stay on track. Life circumstances may change, and your goals may need to be recalibrated accordingly.

8. Celebrate Milestones and Stay Motivated

Remember to celebrate each milestone you achieve. Recognizing your progress and rewarding yourself along the way will help maintain motivation and enthusiasm. Share your victories with friends and family to keep yourself accountable and inspired to continue working towards your ultimate financial goals.

Key Strategies for Achieving Personal Financial Goals

While the goal-setting process is crucial, implementing effective strategies can significantly increase your chances of success. Here are some key strategies to consider when striving to achieve your personal financial goals:

1. Budgeting and Expense Tracking

Creating a detailed budget allows you to allocate your income efficiently and prioritize your expenses towards your goals. Track your expenses regularly to identify areas where you can reduce spending and redirect those funds towards your objectives.

2. Saving and Investing

Building a savings habit is essential for accomplishing your goals. Set up automatic transfers to a separate savings account and explore different investment options that align with your risk tolerance and time horizon. Compound interest can work in your favor, growing your wealth over time.

3. Debt Management

If you have outstanding debts, prioritize debt reduction strategies. Consider paying more than the minimum required amounts, focus on high-interest debts first, and explore options to consolidate or refinance loans to reduce interest costs.

4. Continual Learning and Skill Development

Enhancing your financial literacy and acquiring new skills can broaden your opportunities and increase your earning potential. Attend workshops, webinars, or seminars related to personal finance, investing, or career advancement to unlock new doors towards your financial goals.

5. Regular Review and Reassessment

Revisit your financial goals at regular intervals to ensure they remain relevant and aligned with your changing circumstances. Life events, economic conditions, or personal priorities may necessitate adjustments to your goals or strategies.

6. Seek Support from Financial Communities

Join online or local communities focused on personal finance or wealth creation. Engaging with like-minded individuals can provide you with support, insights, and motivation on your financial journey. Share your successes, challenges, and learn from the experiences of others.

Conclusion

Setting personal financial goals is an important step towards securing your financial future. By following the step-by-step process outlined in this comprehensive guide, you can create a sound financial plan, make informed decisions, and work towards achieving your goals effectively. Remember, success is achieved through dedication, perseverance, and continuous learning. Start your journey towards financial empowerment today with Social Service of America!