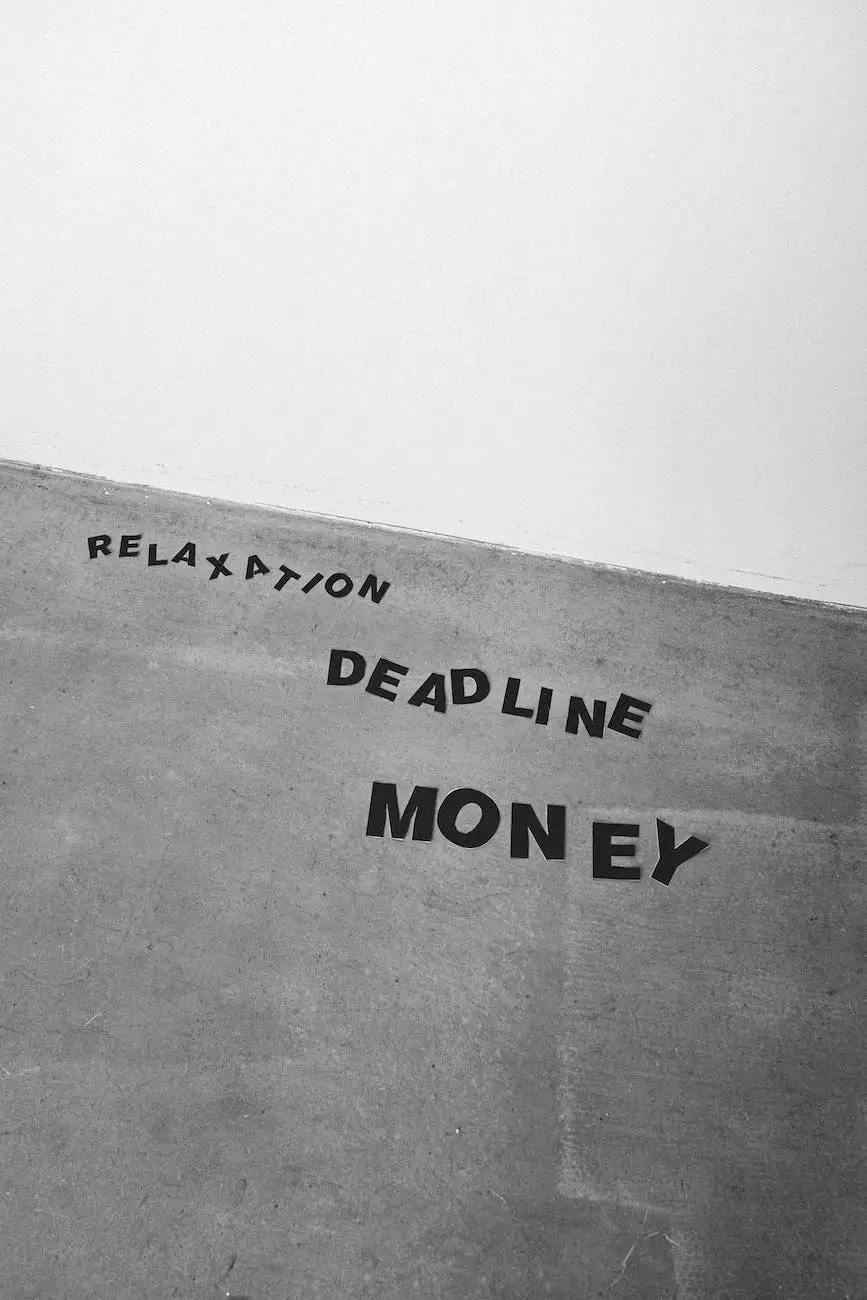

Talking About Debt - Why Is It So Hard?

Our Facility

Welcome to Social Service of America's blog, where we delve into important topics related to our community and society. In this article, we will explore the complexities and difficulties associated with discussing debt. Our aim is to provide comprehensive insights and support to help individuals overcome the challenges of dealing with debt. At Social Service of America, we are dedicated to promoting financial literacy and offering valuable resources to empower individuals and families.

The Impact of Debt on Individuals and Communities

Debt is a prominent issue affecting people from all walks of life. Regardless of socioeconomic status, debt can put significant strain on individuals and their relationships. It is important to address the underlying challenges and reasons why discussing debt is often difficult.

One of the main reasons why debt is hard to talk about is the associated stigma and shame. Society has often viewed debt as a personal failure rather than a result of external factors or circumstances. People may feel embarrassed or judged when discussing their financial situation, making it challenging to seek help or advice.

Furthermore, debt can lead to a sense of isolation and stress, which can have a profound impact on mental health and overall well-being. Many individuals struggling with debt may feel trapped in a cycle of shame and anxiety, preventing them from seeking assistance or speaking openly about their financial challenges.

The Importance of Open Dialogue and Support

Recognizing the difficulties surrounding debt discussions, it is crucial to foster a supportive environment that encourages open dialogue. By sharing experiences and knowledge, we can break down the barriers associated with debt and begin to empower individuals to take control of their financial futures.

At Social Service of America, our goal is to provide resources and support for those facing debt-related challenges. Through education and awareness, we aim to reduce the stigma surrounding debt and encourage individuals to seek assistance without shame or fear of judgment.

Overcoming the Taboo: Strategies for Addressing Debt

1. Education and Financial Literacy Programs: Improving financial literacy is a fundamental component of addressing debt. Social Service of America offers workshops, online courses, and resources to help individuals develop sound money management skills and make informed financial decisions.

2. Support Groups and Peer Networks: Joining support groups or engaging with peer networks can provide encouragement and validation for individuals dealing with debt. Social Service of America facilitates community forums and discussion groups where individuals can connect, share experiences, and find comfort in knowing that they are not alone.

3. Professional Counseling and Debt Management Services: Seeking professional assistance can be essential for individuals struggling to manage their debt. Social Service of America partners with reputable credit counseling agencies and debt management experts who offer personalized guidance and strategies to overcome debt-related challenges.

Conclusion

Debt is a complex issue that affects countless individuals and communities. By normalizing conversations about debt, we can eradicate the stigma and provide the necessary support to help individuals regain control of their financial lives.

At Social Service of America, we are committed to facilitating these conversations and providing the necessary resources for individuals navigating the challenges of debt. Together, we can build a community that prioritizes financial well-being and supports one another through every step of the journey.