Should you get a vanity credit card?

Our Facility

Welcome to Social Service of America! We are a prominent community and society organization dedicated to philanthropy. In this article, we will explore the concept of vanity credit cards and help you determine if they are worth pursuing.

Understanding Vanity Credit Cards

Vanity credit cards have gained popularity in recent years, attracting individuals who want their credit card to reflect their personal interests, affiliations, or hobbies. These specialized cards often feature unique designs, logos, or patterns that resonate with cardholders on a more personal level.

At Social Service of America, we believe it's important to carefully evaluate the pros and cons of vanity credit cards before making a decision. Let's delve deeper into the factors you should consider.

The Benefits of Vanity Credit Cards

One significant benefit of vanity credit cards lies in their ability to express personal identity. By choosing a card that aligns with your passions or associations, you can showcase your interests to the world. This can be especially meaningful for individuals involved in specific communities or causes.

Additionally, some vanity credit cards offer appealing rewards programs tailored to the interests of their cardholders. These rewards might include discounts, exclusive access to events or experiences related to the design theme, or even donations to charitable organizations associated with the card's cause.

Moreover, vanity credit cards often have competitive interest rates, favorable terms, and compatibility with popular payment networks. This means that beyond the design appeal, they can be reliable financial tools for everyday transactions.

Considerations for Vanity Credit Cards

While there are benefits to owning a vanity credit card, it is essential to assess certain aspects before applying:

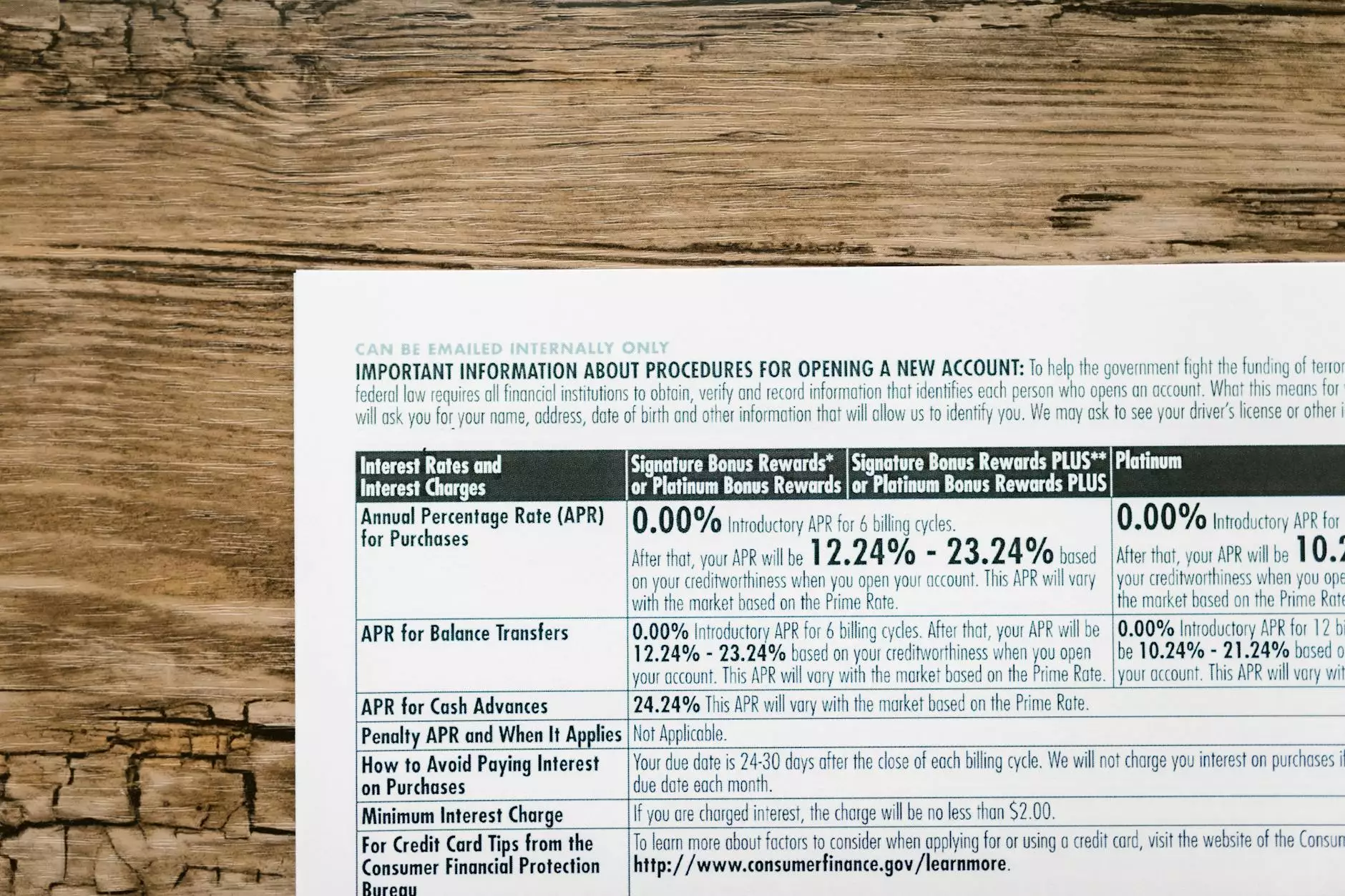

Annual Fees and Interest Rates:

Some vanity credit cards may come with higher annual fees compared to traditional ones. It's crucial to weigh the added cost against the potential rewards and benefits offered by the card. Similarly, understanding the interest rates associated with the card will help you make an informed financial decision.

Availability and Approval:

Not all vanity credit cards are accessible to everyone. Some may have eligibility criteria based on credit history, income level, or affiliation with specific organizations. Before pursuing a vanity credit card, ensure that you meet the necessary requirements.

Long-Term Relevance:

Consider whether the design or theme of the vanity credit card will hold long-term significance to you. While it may be appealing at first, personal interests and affiliations can evolve over time. Ensuring the card aligns with your long-term aspirations is essential to avoid potential regrets.

Impact on Credit Score:

It's important to understand how opening a new credit card account, whether traditional or vanity, can impact your credit score. Be mindful of how it may affect your credit utilization, average account age, and other factors that contribute to your overall creditworthiness.

Making an Informed Choice

At Social Service of America, we believe that every financial decision should be approached with careful consideration. Before obtaining a vanity credit card, evaluate the factors mentioned above and ask yourself whether the potential benefits outweigh any associated costs.

Remember, a credit card – whether vanity or not – is a financial tool that can have long-term implications. Choose wisely and ensure that the card you select aligns with your financial goals and overall lifestyle.

For further guidance or information on philanthropy and community support, please explore our website or reach out to our team at Social Service of America.