How to Manage Debt When You're Retired

Financials & Reports

Welcome to Social Service of America's comprehensive guide on managing debt during retirement. As experts in the field of community and society, particularly in the philanthropy sector, we understand the importance of financial stability for seniors. This guide will provide you with valuable insights and strategies to effectively manage your debt, ensuring a stress-free retirement and peace of mind.

The Importance of Managing Debt in Retirement

Retirement is a phase in life that should be enjoyed without the burden of financial stress. However, debt can significantly impact your quality of life during this period. It is crucial to address and manage your debt effectively to maintain stability and secure your financial future.

1. Assess Your Current Financial Situation: Begin by evaluating your current financial status. Calculate your income, expenses, and outstanding debts. Understanding your financial picture will help you establish a baseline for debt management.

2. Create a Budget: Developing a budget is essential for managing debt. Identify your income sources and allocate funds towards essential expenses such as housing, utilities, healthcare, and food. Prioritize debt payments in your budget to reduce outstanding balances systematically.

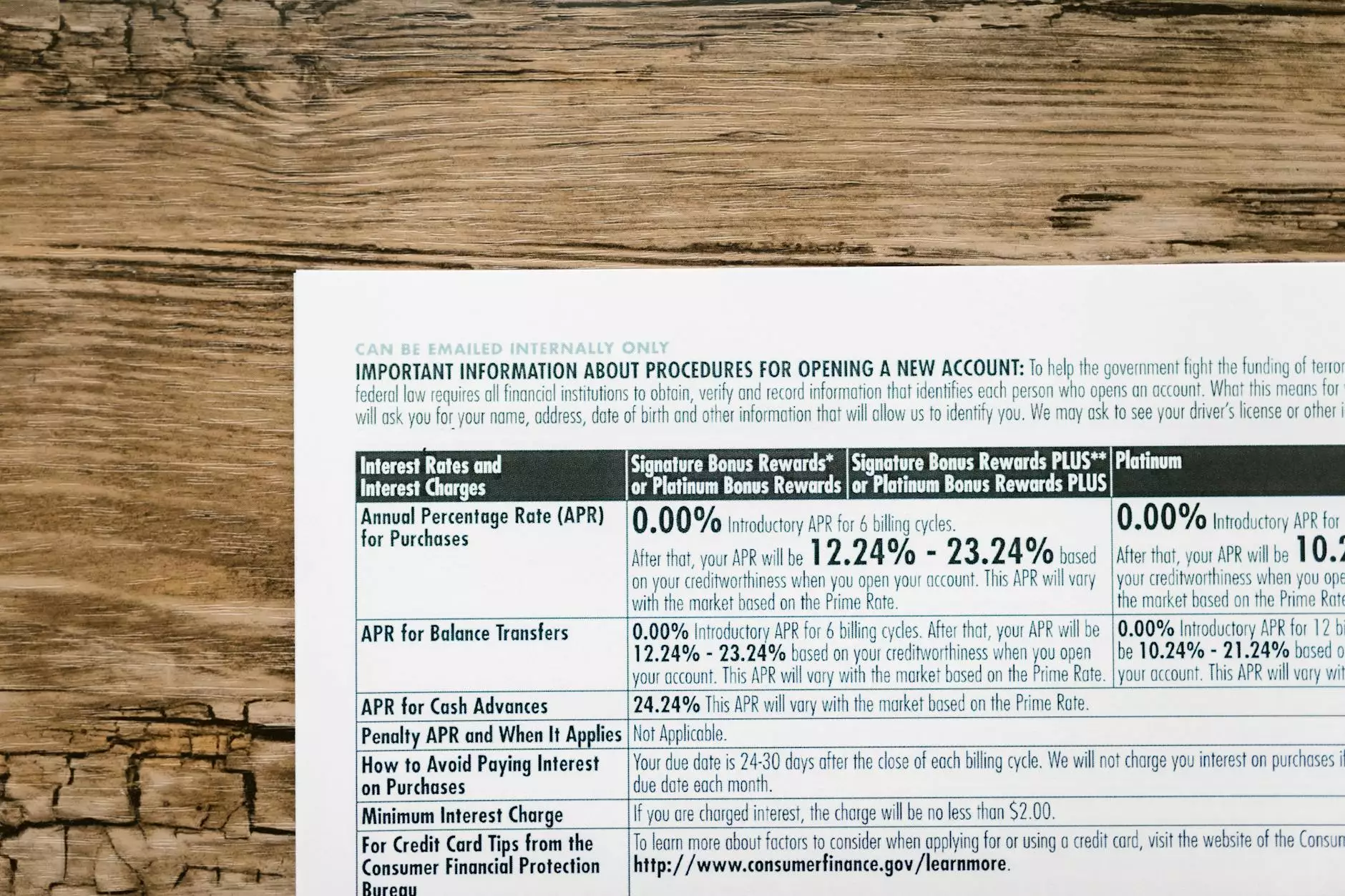

3. Understand Your Debt: Make a list of all your debts, including outstanding balances, interest rates, and payment terms. Categorize your debts into secured (backed by collateral) and unsecured (no collateral). This will give you a clear overview of your debt obligations.

Strategies for Debt Management in Retirement

1. Debt Consolidation

Debt consolidation is a valuable strategy to simplify debt management. Consider consolidating multiple debts into a single loan with a lower interest rate. This allows you to make a single, manageable monthly payment, reducing the risk of missing payments and incurring further penalties.

2. Explore Reverse Mortgage Options

For retirees who own their homes, a reverse mortgage can be a viable option. This enables you to convert a portion of your home's equity into cash, which can be used to pay off existing debts. Consulting with a financial advisor specializing in reverse mortgages will ensure you make an informed decision.

3. Seek Professional Assistance

If you find yourself overwhelmed by debt management tasks, seek professional help. Financial advisors and credit counselors can provide valuable guidance and create a personalized debt management plan tailored to your specific circumstances. They can negotiate with creditors on your behalf, reducing interest rates, and potentially eliminating late fees.

Preventing Debt During Retirement

1. Establish an Emergency Fund: Building an emergency fund is crucial to avoid accumulating debt during retirement. Aim to save three to six months' worth of living expenses to cover unexpected costs.

2. Review Your Insurance Coverage: Ensure your insurance policies adequately cover potential risks such as healthcare expenses, long-term care, and property damage. This will protect your financial well-being and minimize the need to take on additional debt.

3. Downsize and Minimize Expenses: Consider downsizing your home and reducing discretionary spending to free up funds. This can help you stay within your budget while minimizing the need for additional debt.

Conclusion

Managing debt when you're retired is crucial for maintaining financial stability and enjoying a worry-free retirement. By assessing your current financial situation, creating a budget, and exploring effective strategies like debt consolidation, reverse mortgages, and seeking professional assistance, you can take control of your financial well-being. Additionally, taking proactive steps to prevent debt during retirement, such as establishing an emergency fund, reviewing insurance coverage, and minimizing expenses, will contribute to long-term financial security. Remember, Social Service of America is here to assist you every step of the way towards a debt-free retirement. Contact us for personalized guidance and support.