Completing a Bankruptcy Filing

Financials & Reports

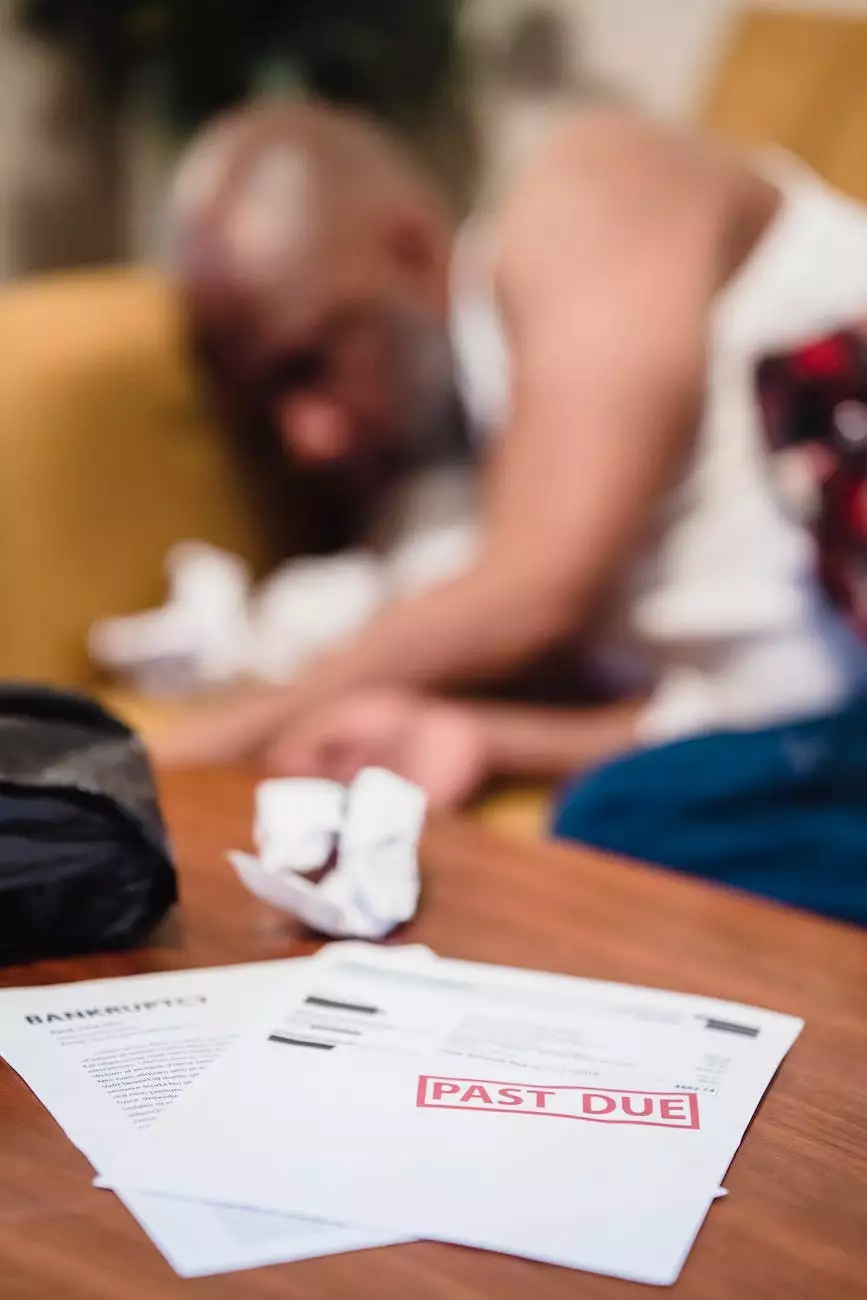

Understanding Bankruptcy: A Fresh Start for Financially Overwhelmed Individuals

In today's challenging economic times, many individuals find themselves facing insurmountable debt. Bankruptcy provides a legal option for those who are unable to meet their financial obligations, offering a fresh start and a chance to rebuild their financial lives.

The Bankruptcy Process: A Step-by-Step Guide

Comprehending the bankruptcy process is crucial before embarking on a filing. Here at Social Service of America, we aim to provide you with all the necessary information to navigate this complex journey. Let's delve into the step-by-step process:

1. Assessing Your Financial Situation

Before initiating a bankruptcy filing, it's important to assess your financial situation thoroughly. Begin gathering important documents such as tax returns, bank statements, and a list of assets and debts. This information will be essential during the filing process.

2. Choosing the Right Bankruptcy Chapter

There are different bankruptcy chapters available, each designed to address different financial circumstances. Chapters include Chapter 7, Chapter 13, and Chapter 11. Understanding the nuances of each chapter will help you determine which one suits your situation best.

3. Consultation with a Bankruptcy Attorney

Seeking legal advice is crucial in the bankruptcy process. A qualified bankruptcy attorney can provide personal guidance tailored to your unique circumstances. Our team at Social Service of America includes experienced attorneys who specialize in bankruptcy cases and can assist you in making informed decisions.

4. Completing and Submitting Bankruptcy Forms

Once you have chosen the appropriate chapter and consulted with an attorney, it's time to complete the necessary bankruptcy forms. These forms require detailed information about your financial history, assets, income, and debts. Accuracy and completeness are essential to ensure a smooth filing process.

5. Attending Mandatory Credit Counseling

Prior to filing for bankruptcy, individuals are required to participate in credit counseling. This counseling aims to provide essential financial management skills and explore alternatives to bankruptcy. Upon completion, you will receive a certificate that needs to be included with your bankruptcy forms.

6. Filing the Bankruptcy Petition

After completing all necessary forms and credit counseling, it's time to file your bankruptcy petition with the appropriate bankruptcy court. This action officially initiates the bankruptcy process and triggers an automatic stay, granting you protection from creditors' collection activities.

7. Attending the Meeting of Creditors

Within a few weeks of filing, a meeting of creditors, also known as a 341 meeting, will be scheduled. During this meeting, you, your attorney, and the bankruptcy trustee will discuss your financial situation. Creditors have the option to attend but rarely do.

8. Completing Financial Management Course

Before your bankruptcy can be discharged, you are required to complete a financial management course. This course focuses on providing skills for budgeting and managing finances effectively, helping you rebuild your financial life after bankruptcy.

9. Receiving Your Bankruptcy Discharge

Upon successful completion of the bankruptcy process, you will receive a bankruptcy discharge. This legally releases you from personal liability for specific debts and marks the formal conclusion of your bankruptcy case.

The Importance of Professional Guidance

Embarking on a bankruptcy filing can be overwhelming, and it's crucial to have the support of experienced professionals. At Social Service of America, we understand the complexities of the bankruptcy process and the impact it can have on your life. Our team of dedicated attorneys and advisors is here to provide you with comprehensive guidance and support throughout your bankruptcy journey.

Choosing Social Service of America

As a philanthropic organization dedicated to serving the community, Social Service of America believes in the power of offering a fresh start to individuals in financial distress. We have built a reputation for our expertise in bankruptcy cases and our commitment to helping individuals regain control of their financial futures. By choosing Social Service of America, you can trust that you will receive the highest level of professional assistance and guidance in completing your bankruptcy filing.