Does Money Management Matter if You're Poor?

Financials & Reports

Introduction

As one of the leading organizations in the field of community and society philanthropy, Social Service of America aims to address the crucial question - does money management matter if you're poor? In this comprehensive article, we will delve into the significance of money management even for individuals within low-income communities. Contrary to popular belief, money management isn't solely reserved for the affluent. It plays a fundamental role in empowering individuals and fostering financial stability, irrespective of one's socioeconomic status.

The Importance of Money Management

Poverty often presents individuals with unique challenges when it comes to managing their finances. However, it is precisely in these circumstances that effective money management can make a significant impact on an individual's life.

1. Breaking the Cycle of Poverty

By developing sound money management skills, individuals from low-income communities can break the cycle of poverty. Understanding personal finances, budgeting effectively, and making informed financial decisions can help individuals improve their circumstances and create a path towards upward mobility.

2. Building a Safety Net

Money management allows individuals to build a safety net that provides stability during financial emergencies. By creating an emergency fund, even with small contributions, individuals can mitigate the impact of unexpected expenses and prevent them from falling deeper into financial hardship.

3. Setting and Achieving Financial Goals

By practicing effective money management, individuals from low-income backgrounds can set and achieve financial goals. Whether it's saving for education, homeownership, or starting a small business, the discipline of money management helps in prioritizing financial objectives and working towards them steadily.

Financial Education in Low-Income Communities

At Social Service of America, we recognize the critical need for financial education in low-income communities. Providing individuals with the necessary knowledge and skills to manage their money effectively is one of our core initiatives. By partnering with local organizations, we deliver comprehensive financial literacy programs tailored to the unique challenges faced by those living in poverty.

1. Budgeting and Expense Tracking

Our financial literacy programs focus on teaching individuals how to create and stick to a budget, regardless of their income level. By tracking expenses and identifying areas for potential savings, individuals can gain control over their finances and make better financial choices.

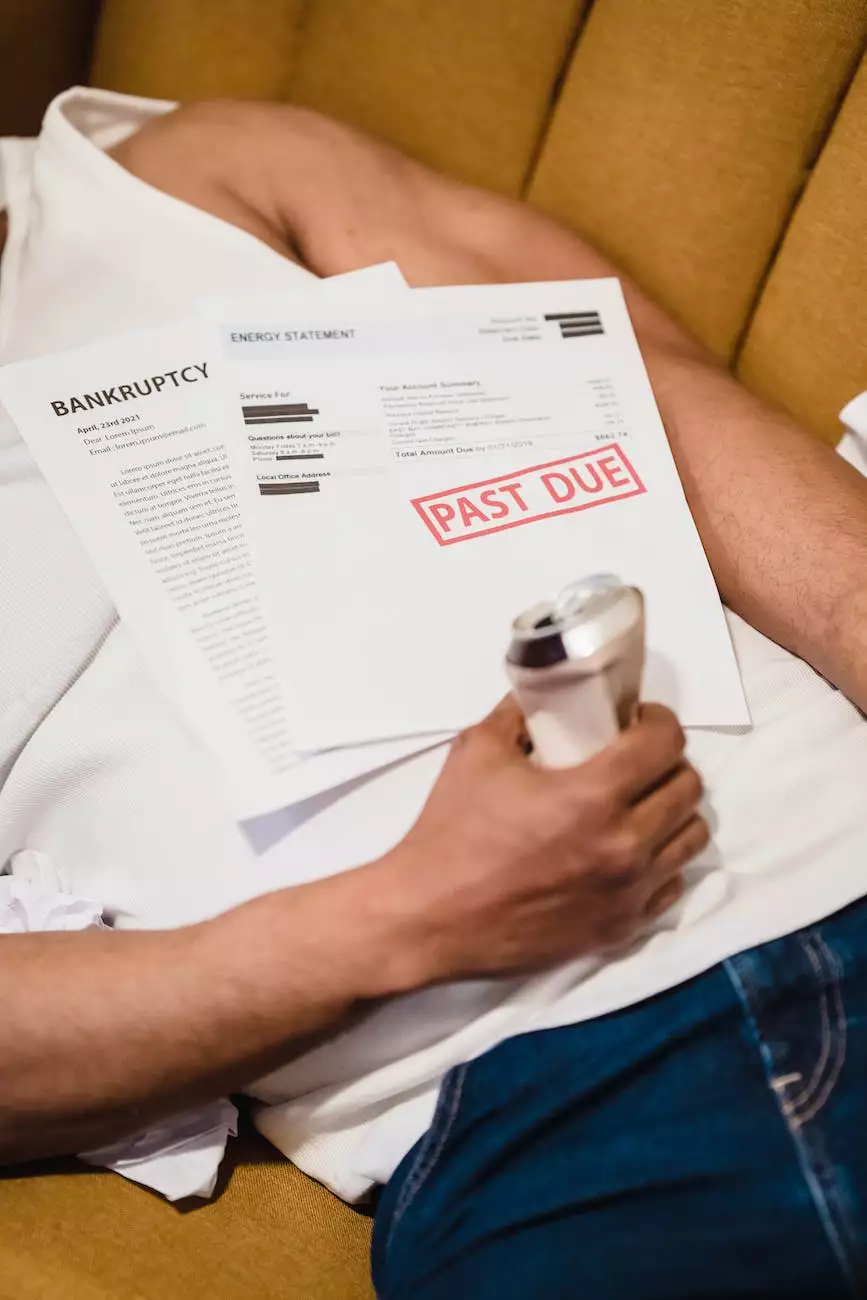

2. Debt Management

We understand that many individuals in low-income communities struggle with debt. That's why our financial education initiatives place significant emphasis on debt management. From understanding interest rates to developing repayment strategies, we equip individuals with the tools to overcome debt and secure a more stable financial future.

3. Access to Banking and Financial Services

Many individuals living in poverty remain unbanked or underbanked, limiting their access to essential financial services. Through our partnerships with local banks and credit unions, we strive to improve financial inclusion. By educating individuals on the benefits of mainstream banking and providing guidance on opening and managing bank accounts, we empower them to take control of their finances.

The Impact of Money Management in Low-Income Communities

The impact of effective money management extends beyond the individual level. When individuals in low-income communities gain financial stability, it positively influences the entire community. Here are a few notable impacts:

1. Reduced Reliance on Public Assistance

As individuals develop their money management skills, they become less reliant on public assistance programs. This not only leads to cost savings for the community but also allows these programs to focus on helping those who truly need them, thereby creating a more equitable system.

2. Increased Economic Resilience

Empowering individuals with money management skills nurtures economic resilience within low-income communities. By encouraging savings and investment, individuals can better withstand economic downturns and work towards building a more prosperous future.

Conclusion

Money management matters greatly, regardless of one's socioeconomic status. At Social Service of America, we firmly believe that everyone, including individuals living in poverty, deserves the tools and knowledge to manage their finances effectively. By providing comprehensive financial education and support, we strive to make a lasting impact on the lives of individuals and communities, empowering them to break free from the cycle of poverty and move towards a brighter future.