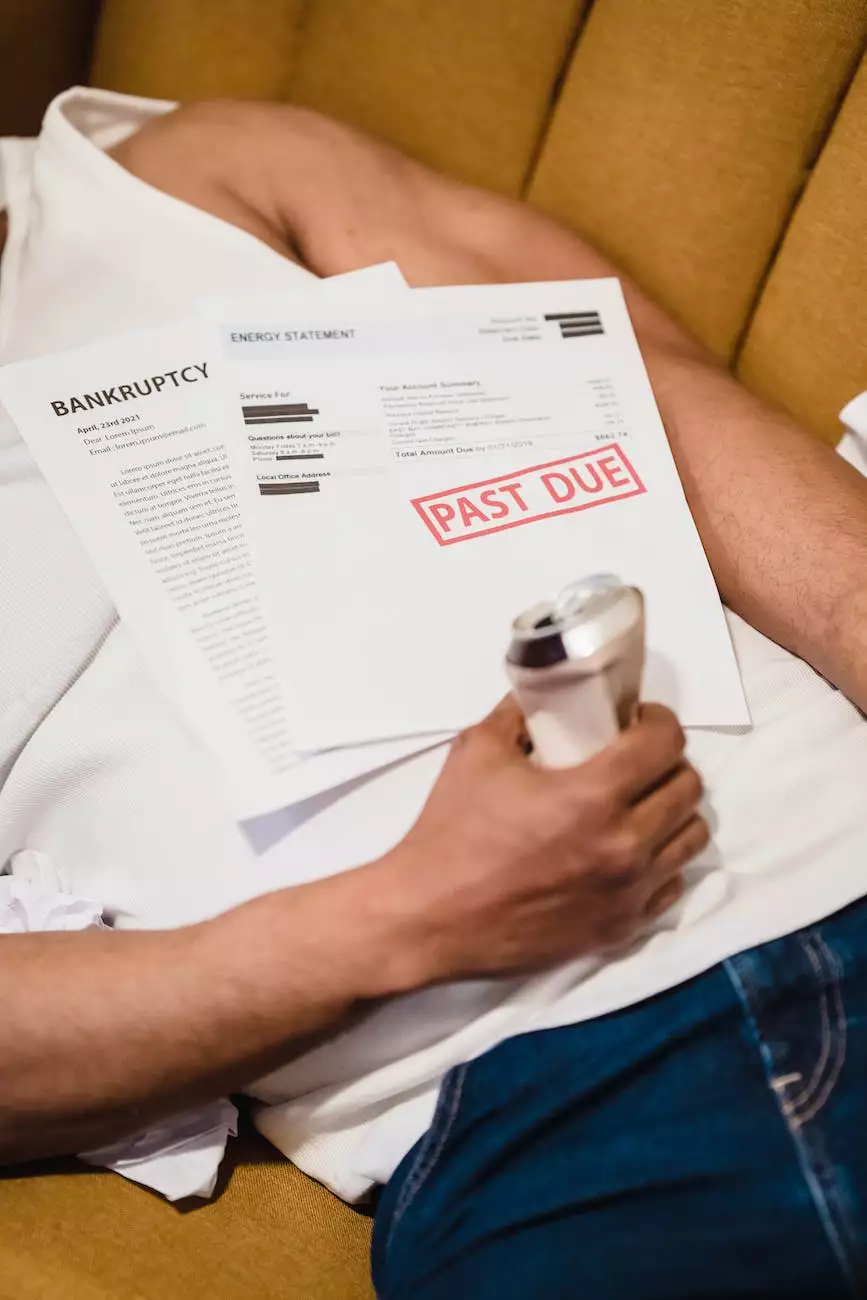

What Happens When You File for Bankruptcy?

Financials & Reports

Introduction

Welcome to the informative guide brought to you by Social Service of America where we delve into the intricacies of the bankruptcy filing process. As a respected organization in the community and society philanthropy realm, we aim to equip individuals with comprehensive knowledge about the repercussions, benefits, and overall journey associated with filing for bankruptcy. Whether you're contemplating this financial decision or seeking a deeper understanding, this guide provides a wealth of information to help you make an informed choice.

Chapter 1: Understanding Bankruptcy

Bankruptcy is a legal proceeding for individuals or businesses who are unable to repay their outstanding debts. It is essentially a financial fresh start that helps alleviate the burden of overwhelming debts and offers an opportunity for individuals to reorganize their financial affairs. There are different types of bankruptcy, including Chapter 7 and Chapter 13, each with its own set of rules and requirements. Understanding the basics of bankruptcy is crucial before delving into the process.

Chapter 1.1: Chapter 7 Bankruptcy

Chapter 7 bankruptcy, also known as liquidation bankruptcy, involves the sale of non-exempt assets to pay off creditors. It is typically suited for individuals with limited income and few assets. Filing for Chapter 7 bankruptcy provides immediate relief from debt collection efforts, giving individuals a chance to rebuild their financial lives without the weight of unmanageable debts.

Chapter 1.2: Chapter 13 Bankruptcy

Chapter 13 bankruptcy, on the other hand, is a reorganization plan that allows individuals with a steady income to develop a repayment plan to fully or partially pay off their debts within a predetermined period, usually three to five years. This type of bankruptcy is particularly suitable for individuals with a consistent income who want to retain their assets and repay creditors over time in a more structured manner.

Chapter 2: The Bankruptcy Filing Process

Chapter 2.1: Eligibility Criteria

Before filing for bankruptcy, it's essential to understand the eligibility criteria stipulated by the bankruptcy code. Meeting these requirements ensures a smoother process and increases the chances of a successful petition. Some key eligibility aspects include the type of bankruptcy, income, previous bankruptcy filings, and completion of credit counseling courses. Our team at Social Service of America can guide you through these criteria to determine which bankruptcy option suits your unique circumstances.

Chapter 2.2: Filing the Bankruptcy Petition

Filing the bankruptcy petition is a crucial step that initiates the legal process. It involves preparing the necessary documentation, including income statements, a list of assets and liabilities, expense details, and any pending lawsuits or garnishments. Accuracy and completeness are vital to ensure a successful petition, and seeking professional assistance can streamline this intricate process.

Chapter 3: Effects of Bankruptcy

Chapter 3.1: Automatic Stay

When you file for bankruptcy, an automatic stay is put into place, which halts all collection efforts from creditors. This means they can no longer pursue legal actions, contact you for payment, or repossess assets without court approval. The automatic stay provides immediate relief and offers a breathing space to individuals overwhelmed by debt.

Chapter 3.2: Credit Impact

Bankruptcy has an impact on your credit score and history. While there is no denying that it may negatively affect your creditworthiness in the short term, bankruptcy also offers an opportunity to rebuild your credit over time. With responsible financial habits and strategic planning, it is possible to restore your credit standing and regain financial stability.

Chapter 4: Benefits and Alternatives

Chapter 4.1: Debt Discharge

One of the primary benefits of filing for bankruptcy is debt discharge, whereby certain debts are forgiven or eliminated. This can provide a significant relief for individuals struggling with overwhelming debt burdens. Understanding which debts are eligible for discharge and the potential exemptions is crucial when considering bankruptcy as a financial solution.

Chapter 4.2: Alternative Options

While bankruptcy can be a viable option for many, it is essential to explore alternative debt relief solutions as well. Debt consolidation, debt settlement, and credit counseling are among the alternative options that Social Service of America can provide insights on to help individuals make informed decisions regarding their financial situation.

Conclusion

As you can see, filing for bankruptcy is a complex process, but one that offers relief and a fresh financial start for individuals burdened by overwhelming debt. Social Service of America is here to guide and support you throughout this journey, ensuring you have the information needed to make the best decision for your unique circumstances. Reach out to our team for expert advice and compassionate assistance in navigating the path to financial freedom.