Credit Impact of a Debt Settlement Program

Financials & Reports

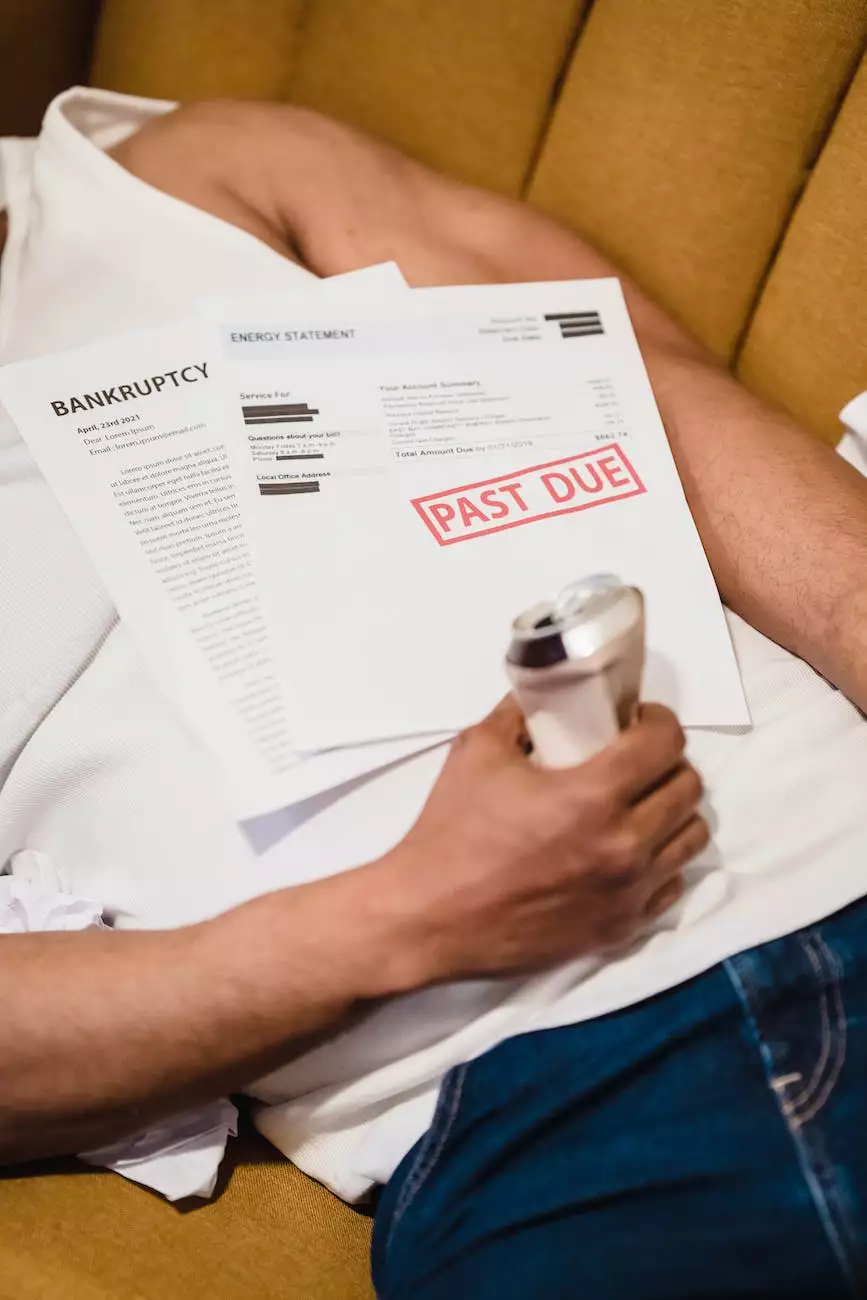

Welcome to Social Service of America's comprehensive guide on the credit impact of a debt settlement program. If you are struggling with debt and considering a debt settlement program, it's important to understand how it may affect your credit score and financial future. In this article, we will explore the ins and outs of debt settlement and provide you with valuable insights to make an informed decision.

Understanding Debt Settlement

Debt settlement is a strategy employed by individuals who are unable to repay their debts in full. It involves negotiating with creditors to accept a lump-sum payment that is less than the total amount owed. This can provide significant relief for individuals facing overwhelming debt burdens.

However, it's crucial to recognize that debt settlement may have an impact on your credit score. While your credit score is not the sole factor to consider when deciding on a debt settlement program, understanding the potential credit implications is essential.

The Credit Score Impact

When you participate in a debt settlement program, it's important to remember that your credit score may be negatively affected. This is primarily because debt settlement involves not paying the full amount owed to your creditors as originally agreed. This non-payment history can leave a mark on your credit report, making it more challenging to obtain credit in the future.

While a debt settlement program does not directly lower your credit score like bankruptcy does, it can still have a considerable impact. Typically, creditors report settled accounts as "settled" or "paid as settled" on your credit report. These notations indicate to future lenders that you did not fulfill your original debt obligations fully.

It's important to note that the impact on your credit score may vary depending on your individual circumstances. Factors such as your current credit score, credit history, and the number of accounts settled can influence the severity of the impact.

Rebuilding Your Credit

Although participating in a debt settlement program may temporarily impact your credit score, it doesn't mean that you will never be able to rebuild it. With careful planning and responsible financial management, it is possible to improve your creditworthiness after completing a debt settlement program.

Here are some steps you can take to start rebuilding your credit:

- Create a Budget: Develop a realistic budget to manage your finances effectively and ensure you can meet your obligations.

- Pay Bills On Time: Make timely payments for all your remaining debts and monthly obligations to demonstrate responsible financial behavior.

- Build an Emergency Fund: Set aside funds for unexpected expenses to avoid relying on credit in times of financial uncertainty.

- Apply for Secured Credit: Consider obtaining a secured credit card and use it responsibly to gradually rebuild your credit history.

- Monitor Your Credit Report: Regularly check your credit report for errors or inaccuracies. Dispute any incorrect information promptly to maintain an accurate credit profile.

By following these steps and adopting healthy financial habits, you can slowly rebuild your credit score and improve your overall financial standing.

Conclusion

In conclusion, while participating in a debt settlement program offered by Social Service of America can provide a viable solution to managing your debt, it's essential to understand the potential credit impact. By weighing the pros and cons, you can make an informed decision that aligns with your financial goals and priorities.

Remember, debt settlement is not a one-size-fits-all solution, and it's always advisable to seek professional advice from experts at Social Service of America or a qualified financial advisor. Together, we can help you navigate the best path to a debt-free and financially stable future.